Carter Credit Union - Your Financial Community Partner

Thinking about where you keep your money, or maybe even where you go for a little help with a big purchase, is that something on your mind? Well, you might be surprised to learn that there's a place that really puts its people first, offering a welcoming spot for all your money matters. This isn't just about numbers and transactions; it's more about building connections and helping folks in the area get ahead financially, which is pretty neat.

You see, a lot of people are looking for a financial partner that feels a bit more personal, a place where they're not just another account number. It's almost like finding a helpful neighbor who genuinely cares about your well-being, rather than just trying to sell you something. That's actually a core idea behind places like Carter Credit Union, where the focus is truly on the people who belong there, making sure they have what they need to manage their funds easily.

It's about having a friendly face, or at least a helpful voice, when you have questions about your savings, or perhaps when you're looking to borrow some money for something important. They are, in a way, set up to serve their members, offering a wide array of financial services, very much like a traditional bank, but with a unique twist that tends to benefit the people who are part of their group.

Table of Contents

- What Makes Carter Credit Union Different from a Bank?

- How Does Carter Credit Union Support Families?

- Staying Connected with Carter Credit Union's Digital Tools

- What Kind of Financial Help Can You Get from Carter Credit Union?

- Budgeting and Saving Made Simple with Carter Credit Union

- Carter Credit Union's Commitment to Local Progress

- Always There for You - Carter Credit Union's 24/7 Support

- Making Life Easier with Carter Credit Union's Free Checking

What Makes Carter Credit Union Different from a Bank?

So, you might be asking yourself, "What's the real difference between a credit union and a regular bank?" Well, basically, Carter Credit Union, just like other credit unions, is set up to serve its members. This means that instead of being owned by a few big investors, it's actually owned by the very people who use its services. That's a pretty big deal, you know? This structure typically means that any profits made are often put back into the organization, perhaps through better interest rates on savings or lower fees on loans, which is a nice perk for members.

They do, however, perform many of the same important duties as banks. For instance, Carter Credit Union is happy to accept deposits from its members, giving them a secure place to keep their hard-earned money. They also make loans available for various needs, helping people finance things like a new car or maybe even a home improvement project. And, really, they provide a whole collection of financial services that you'd typically expect to find at any money institution. It's almost like having all the helpful tools you need for your money life, but with a more community-focused approach, which can feel quite comforting.

The core idea here is that they exist for the benefit of their members, not for making a huge profit for outside shareholders. This kind of arrangement often means a more personal touch, a bit more flexibility, and perhaps a stronger tie to the local area. It's that sense of belonging that really sets a place like Carter Credit Union apart, giving people a financial home where their needs are truly put first, rather than just being a customer number.

How Does Carter Credit Union Support Families?

Families, especially those with younger kids, often look for smart ways to handle money and teach good habits early on. It's something many parents think about, how to give their children a good start with finances. That's where Carter Credit Union steps in with some pretty neat options. You see, members of Carter Credit Union can get something called Greenlight, which is actually a really helpful tool for families.

Greenlight, for instance, allows parents to give their kids money digitally, set spending limits, and even assign chores with payments attached. It’s a way to teach children about earning, saving, and spending responsibly in a safe, controlled environment. This feature, available through Carter Credit Union, means that managing pocket money or teaching about budgeting becomes a little less complicated and a lot more interactive for everyone involved. It really helps to bridge the gap between abstract money lessons and practical, real-world experience, which is quite valuable for growing minds.

So, in a way, Carter Credit Union isn't just about adult financial services. It also seems to understand that a big part of a family's financial health involves teaching the next generation. By offering access to tools like Greenlight, they're helping parents guide their children toward a better grasp of money management from a younger age, preparing them for the future. It's a thoughtful addition that shows they really consider the diverse needs of the families who choose to be part of their financial community.

Staying Connected with Carter Credit Union's Digital Tools

In our busy lives, being able to keep up with your money from wherever you are is very, very helpful. Nobody wants to be tied to a specific place or time just to check on their accounts, right? That's why Carter Credit Union makes sure its members can stay connected to their finances even when they're out and about. They offer the Carter Mobile24 app, which is basically like having a little financial assistant right there on your smartphone or tablet.

With this app, you can do quite a lot of things. For example, you can easily look at your accounts to see what's going on with your money. If you get a check, you can deposit it without having to go to a physical location, which is a real time-saver. Paying bills becomes a lot simpler too, as you can take care of them right from your device. And, if you need to move money around, say from your savings to your checking account, you can transfer funds with just a few taps. It's all about making your financial life just a little bit smoother and more accessible, no matter where you happen to be.

This ability to manage everything from your phone or tablet means you have a great deal of control and convenience. It gives you peace of mind, knowing that you can handle your money matters whenever the need arises, whether you're at home, at work, or even on a short trip. The Carter Mobile24 app really puts your financial information and control directly into your hands, making it easier to stay on top of things without any fuss.

What Kind of Financial Help Can You Get from Carter Credit Union?

When you're thinking about big purchases, like a new car, or maybe you're just looking for a bit of financial support, having someone who understands your unique situation can make all the difference. It's not about a one-size-fits-all approach; it's about finding something that truly fits you. Carter Credit Union understands this and works to offer lending products that are right for your specific financial picture.

For instance, if you're hoping to roll off the lot in style and comfort with a new auto, Carter Credit Union has lending options that can help make that happen. They aim to provide some of the best lending products out there, making sure that what you get truly matches your individual needs and circumstances. This means they take the time to consider your personal financial situation, rather than just giving you a standard package. It's a more thoughtful way of providing financial assistance, helping you get what you need without feeling pressured into something that doesn't quite work for you.

They also make it easy to manage any loans you might have with them. You can, for example, transfer funds to pay your Carter loan directly, which simplifies the repayment process. This kind of convenience shows that they're thinking about the whole experience for their members, from getting the loan to paying it back. It's about providing solutions that are not just effective, but also easy to use and understand, helping you feel more in control of your financial commitments.

Budgeting and Saving Made Simple with Carter Credit Union

Trying to keep track of your money, where it goes, and how much you're saving can sometimes feel like a bit of a puzzle. It's a common challenge for many people, trying to make sense of all the ins and outs of their daily spending. Luckily, Carter Credit Union offers some truly easy-to-use tools that are designed to help you with both budgeting and saving your money, which is pretty helpful for anyone trying to get a better handle on their finances.

One of the nice features they provide is the ability to categorize your transactions. This means that every time you spend money, or perhaps receive money, you can put it into a specific group. For example, you might have categories for groceries, entertainment, housing, or transportation. This simple act of categorizing makes it much easier for budget tracking, allowing you to see exactly where your money is going each month. It gives you a clear picture of your spending habits, which is the first step toward making informed decisions about your money.

These budgeting and saving tools are designed to be straightforward, so you don't need to be a financial expert to use them effectively. They help you visualize your financial situation, spot areas where you might be able to save a little more, and generally feel more in charge of your money goals. It's about empowering you to make smarter choices with your funds, giving you a better chance to reach those personal saving targets you've set for yourself.

Carter Credit Union's Commitment to Local Progress

You know, it's really quite important for local organizations to be involved in their communities, to help them grow and adapt. It's not just about providing services; it's also about looking ahead and bringing new ideas to the table. At Carter Credit Union, there's a strong dedication to being local leaders in technology and innovation. This means they're always looking for new and better ways to serve their members and the broader community, which is a good sign of a forward-thinking institution.

They are, in a way, committed to introducing new products that can genuinely drive the community forward. This could mean anything from more convenient digital services to perhaps new types of loans that meet emerging needs in the area. Their strategic thinking, combined with this desire to innovate, means that they're not just sitting back and doing things the old way. They're actively trying to find solutions that can make a real difference for the people and businesses around them.

This focus on progress means that Carter Credit Union is more than just a place to keep your money. It's actually a partner in the community's development, always seeking ways to improve financial access and opportunities for everyone. They aim to be at the forefront of financial services in their area, ensuring that their members have access to the most current and helpful tools available. It's about building a stronger, more financially savvy community, one step at a time.

Always There for You - Carter Credit Union's 24/7 Support

Life doesn't always stick to a 9-to-5 schedule, and sometimes you need to check on your money matters outside of regular business hours. It's a common situation, isn't it, when a question pops into your head late at night or early in the morning? That's where having constant access to your account information becomes incredibly useful. Carter Credit Union understands this need for flexibility, which is why they offer Carter Connect24.

Carter Connect24 is their 24/7 phone service, and it's set up to give you a quick and convenient way to manage your accounts. This means you can access your account information anytime, anywhere, just by making a phone call. Whether you're wondering about your balance, checking on a recent transaction, or perhaps need some other detail about your account, you can get that information from the comfort of your own home, or really, from wherever you happen to be. It's designed to be a straightforward and reliable way to stay informed about your money.

This constant availability provides a real sense of security and convenience. You don't have to wait for the next business day or worry about office hours. If you have a question or need to check something important, help is literally just a phone call away, any hour of the day or night. It's a clear sign that Carter Credit Union is committed to supporting its members whenever they might need assistance with their financial details.

Making Life Easier with Carter Credit Union's Free Checking

When it comes to managing your everyday money, having a checking account that's simple and doesn't come with a lot of extra costs can be a real blessing. Nobody wants to deal with unexpected fees or complicated rules just to access their own money, right? That's why Carter Credit Union offers a free checking account, which is basically designed to help keep things as straightforward as possible for you.

This free checking account is a pretty good option for general use, and it's also great as a household account. This means that if you're managing family finances, or perhaps just your own daily spending, it provides a practical and cost-effective way to do so. You can use it for your regular income, for paying bills, and for all those everyday transactions without having to worry about monthly service charges or minimum balance requirements that can sometimes be a bit of a burden.

The idea behind offering a free checking account is to make financial management less of a hassle. It’s about providing a basic, yet really useful, service that supports your daily money needs without adding any unnecessary complications. It tends to simplify your financial life, giving you a reliable place to handle your funds without any hidden surprises, which is always a welcome thing for anyone looking for peace of mind with their money.

So, what we've looked at here is that Carter Credit Union is set up to serve its members, much like banks, but with a community-focused approach. They offer tools like Greenlight to help families, and their Carter Mobile24 app lets you manage accounts from your phone. You can get different kinds of loans that fit your situation, and they have easy-to-use budgeting tools. They also work to bring new technology to the community and offer 24/7 phone support. Plus, they have a free checking account that keeps things simple for your everyday money needs.

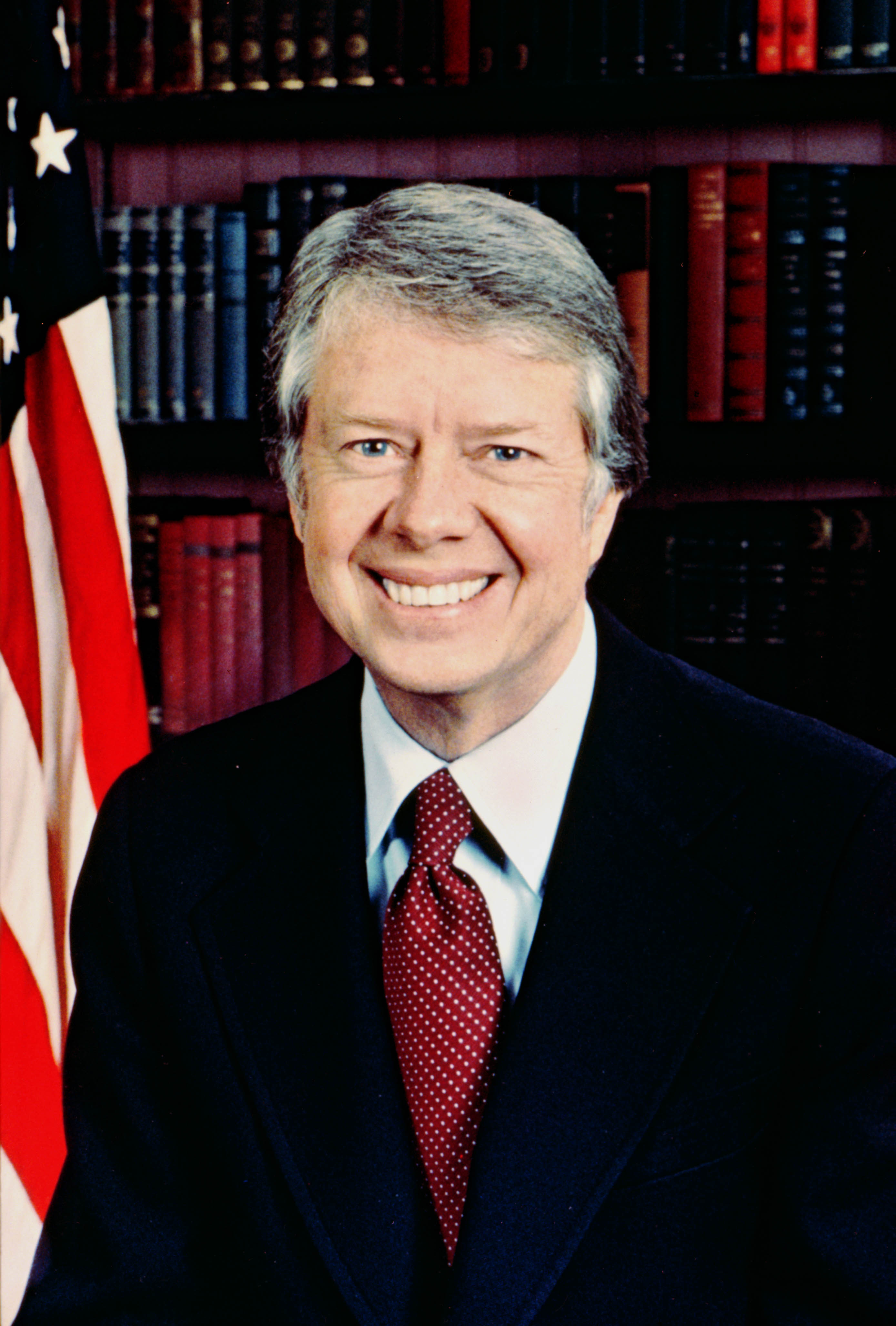

Jimmy Carter - Presidency, Wife & Health - Biography

President Carter has now lived longer than President Adams – and why

:max_bytes(150000):strip_icc():focal(749x399:751x401)/Former-President-Jimmy-Carter-092922-0591f3db9f6947a59de1e83921337c45.jpg)

Jimmy Carter's Hospice Care Is 'Intentional' Choice, Expert Suggests